A lot of consideration goes in to buying a home – but have you thought about it ALL?

Source: Rob Lewine / Getty

5 Things to Think about When Buying a Home

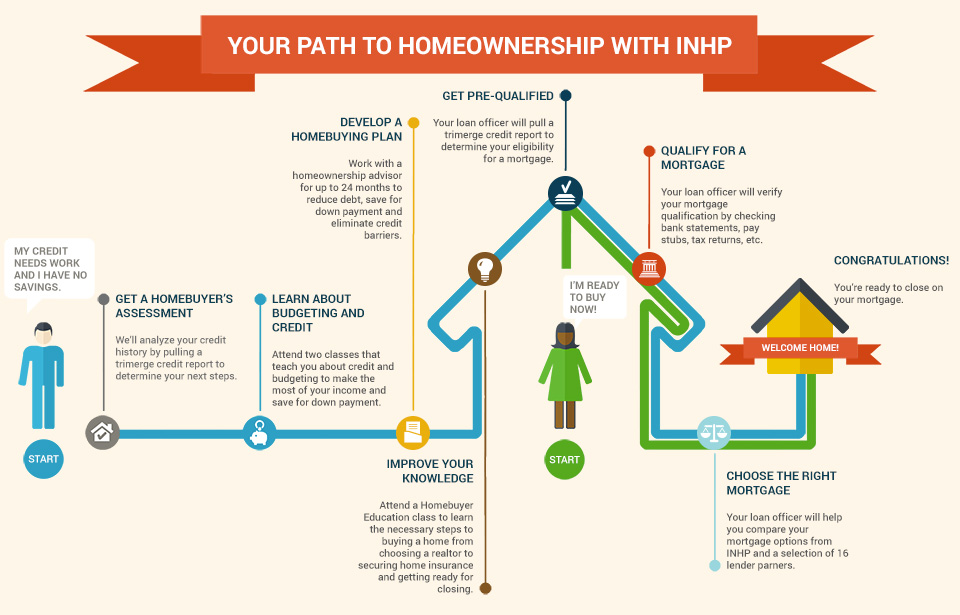

- Get a Homebuyers’ Assessment

Source: Courtney Keating / Getty

Are you ready to buy? Take an assessment to understand your credit report and plan for the next steps.

- Learn About Budget and Credit

Source: carebott / Getty

Find someone to teach you about credit and budgeting so you can properly plan for your down payment and all of the other costs that come with buying a home.

- Develop a Home Buying Plan

Source: Dean Mitchell / Getty

Start planning! Don’t go shopping without a list. What are you waiting for? Find a home ownership adviser to help you craft a plan to save, reduce debt and clean up your credit.

- Improve Your Knowledge

Source: H. Armstrong Roberts/ClassicStock / Getty

Knowledge is Power! This is the biggest purchase of your life! Know the essentials by taking a home buyer education class. Learn everything from choosing a realtor, understanding mortgage insurance, all the way to closing.

- Get Pre-Qualified

Source: Rob Daly / Getty

Find out what type of house you can buy by getting pre-qualified. Know your FICO score. You don’t want to be considering a home outside of your price range – see how much of a house you can afford before you even start looking!

Being prepared can help you find your dream home! The Indianapolis Neighborhood Housing Partnership (INHP) is here to help you through the daunting process of buying a home. Visit http://www.inhp.org/buy-a-home/ to get started today!

Source: Indianapolis Neighborhood Housing Partnership/INHP